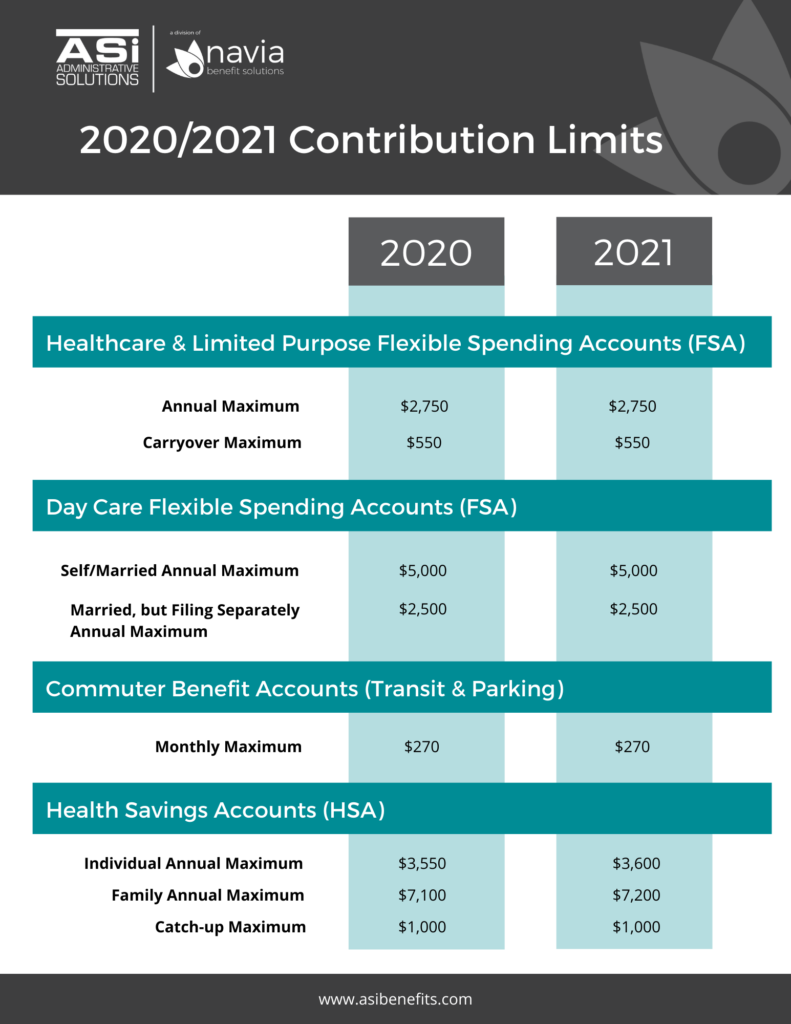

FSA & HSA 2021 Contribution Limits

The IRS recently announced the 2021 contribution limits for Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) when it issued Revenue Procedure 2020-15. The dollar limit contribution maximum for Healthcare and Limited Purpose FSAs will remain the same, $2,750. Day Care FSAs contribution limits also remain unchanged, Single/Married – $5,000 or Married, Filing Separately – $2,500. Commuter Benefit Account monthly contribution limits have also remained the same at $270 per plan.

For Healthcare and Limited Purpose FSA plans that allow a carryover of leftover funds, the maximum amount has been increased to $550 (a $50 increase from 2020).

Health Savings Accounts maximum contribution limits have increased for 2021. Individuals can contribute up to $3,600 and families can contribute up to $7,200.

Click to view and download our 2020/2021 contribution limit guide below!